CONQUER YOUR FINANCES: OVERCOMING UNIQUE MONEY CHALLENGES WITH EXPERT PLANNING

“I think, therefore I am.” – René Descartes

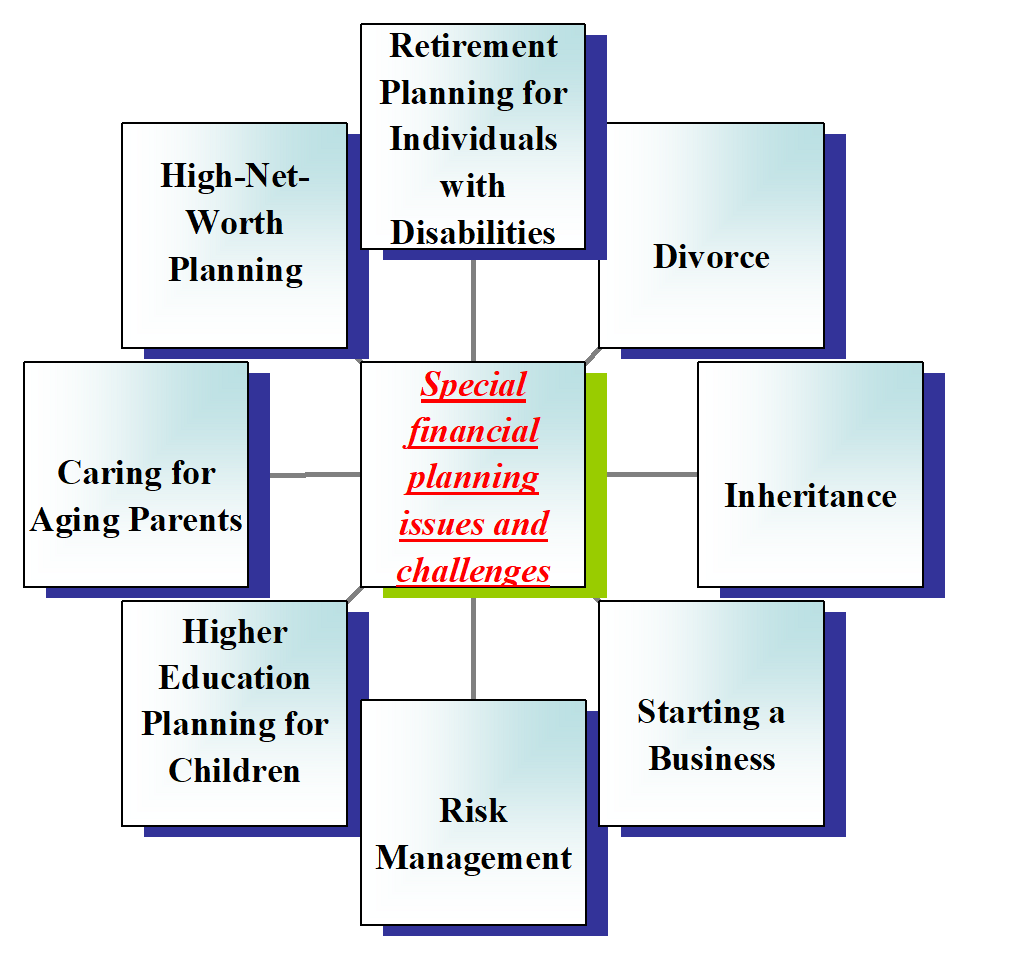

Special financial planning issues and challenges can arise due to specific circumstances or unique situations that individuals or families may face.

In the modern world, managing your finances has evolved into a multifaceted endeavor. The complexities of today’s financial landscape bring forth a diverse array of challenges that demand careful navigation and strategic foresight. From unanticipated expenses that arise out of the blue to intricate investment decisions that require meticulous consideration, the realm of finance can often appear overwhelming. This blog post is here to guide you through the process of conquering these financial intricacies, particularly the unique challenges that set themselves apart.

A selection of these matters and obstacles encompass:

· Retirement Planning for Individuals with Disabilities:

Individuals with disabilities may have unique financial planning needs, such as the need for special equipment or in-home care, which can affect retirement planning.

· Divorce:

Divorce can have a significant impact on an individual’s financial situation, including their retirement savings, taxes, and estate planning. Divorce can significantly impact financial plans, requiring asset division, alimony, and child support considerations. Post-divorce financial stability and long-term planning become essential. A financial planner can help individuals navigate the financial implications of divorce.

· Inheritance:

Receiving an inheritance can also have significant financial implications. A financial planner can help individuals understand how to manage and invest their inheritance wisely.

· Starting a Business:

Starting a business can be a complex financial decision, and it’s important to have a financial plan in place to ensure the business is financially viable and sustainable.

· Caring for Aging Parents:

Many individuals may need to provide financial support for their aging parents. This can impact their own financial planning, and it’s important to have a plan in place to manage these expenses.

· Higher Education Planning for Children:

Saving for a child’s higher education is another important financial planning concern, as the cost of education continues to rise. A financial planner can help parents develop a plan to save for their child’s education while still achieving their other financial goals.

· Risk Management:

Risk management involves developing a strategy to protect assets from potential risks such as lawsuits, disability, and premature death. This may include purchasing insurance policies, creating an emergency fund, and establishing a power of attorney.

· High-Net-Worth Planning:

High-net-worth individuals have unique financial planning needs, such as wealth preservation, estate planning, and tax optimization. Proper management of significant assets requires specialized strategies.

· Business Owners:

Business owners need to balance personal and business finances, plan for business succession, and manage cash flow fluctuations. They may also face challenges related to funding their businesses and planning for retirement.

· Expatriates:

Individuals living and working abroad may encounter complex tax and regulatory issues, currency fluctuations, and differences in healthcare and social security benefits.

· Blended Families:

Financial planning for blended families involves addressing the complexities of multiple family members, assets, and potential inheritances, as well as ensuring fair distribution and protection for all members.

· Retirement Planning:

The challenge of maintaining a comfortable lifestyle during retirement requires careful planning, considering factors such as inflation, healthcare costs, and potential longevity.

· Sudden Windfalls:

Receiving a sudden windfall, such as an inheritance or lottery winnings, can be overwhelming without proper planning to manage and preserve the newfound wealth.

· Cross-Border Financial Planning:

Individuals with international assets, income, or citizenship face cross-border tax and legal complexities that require specialized advice.

Financial planning professionals can help navigate these special issues and challenges by providing personalized advice and developing comprehensive strategies tailored to an individual’s specific circumstances and goals.

Overall, financial planning is a comprehensive process that considers an individual’s specific goals and circumstances to develop a customized strategy for achieving financial security and success.

Each of these special planning concerns requires a unique approach and strategy to ensure adequate financial security and meet specific financial goals.

HOW TO ADDRESS SPECIAL FINANCIAL CHALLENGES AND ISSUES

Addressing special financial challenges and issues requires a thoughtful and strategic approach. Here are some steps to help address these challenges:

· Seek Professional Guidance: Special financial challenges often require expert advice. Consult with financial planners, tax advisors, estate planning attorneys, and other professionals who specialize in the specific area of concern. While the prospect of addressing unique financial challenges might induce apprehension, the good news is that there exists a viable pathway to surmounting them. This pathway is illuminated by the expertise of professional financial planning, a potent tool that can transform challenges into opportunities for growth and financial stability. Seasoned financial planners possess a treasure trove of knowledge and experience, enabling them to navigate intricate financial scenarios with adeptness and assurance.

1. Personalized Strategies: One size does not fit all when it comes to addressing unique financial challenges. Accomplished financial planners take into account your distinctive circumstances and tailor strategies that seamlessly align with your aspirations, principles, and individual situation.

2. Comprehensive Analysis: Resolving unique money challenges demands an exhaustive examination of your financial landscape. Expert planners conduct meticulous analyses to unearth concealed opportunities and pinpoint potential stumbling blocks.

3. Risk Mitigation: Unique challenges often amplify financial risks. Expert planners not only help identify these risks but also devise strategies to mitigate them effectively, safeguarding your financial stability.

4. Long-Term Vision: Special financial challenges often carry enduring repercussions. Expert planners assist you in looking beyond immediate hurdles and crafting a sustainable financial roadmap that extends well into the future.

· Assess Your Financial Situation: Understand your current financial situation, including assets, liabilities, income, and expenses. Identifying your financial strengths and weaknesses will help you develop a plan to address challenges.

· Set Clear Financial Goals: Define specific and achievable financial goals that address your unique challenges. Whether it’s managing debt, saving for retirement, or planning for special needs, having clear objectives will guide your decisions.

· Create a Customized Financial Plan: Work with a financial planner to develop a personalized financial plan that addresses your special challenges and aligns with your goals. This plan should consider short-term and long-term strategies.

· Prioritize Your Financial Actions: Determine which financial actions are most critical and prioritize them based on urgency and impact. Focus on addressing high-priority challenges first.

· Budget and Cash Flow Management: Develop a budget that reflects your financial priorities and helps you manage cash flow effectively. Controlling expenses and maximizing savings are crucial to overcoming challenges.

· Review and Update Your Estate Plan: For issues related to estate planning, ensure your will, trusts, and beneficiaries are up-to-date and aligned with your wishes.

· Research Available Resources: Seek out resources and support available for individuals facing similar financial challenges. Government programs, support groups, and community services may provide assistance.

· Address Insurance Needs: Ensure you have adequate insurance coverage to protect against potential risks, such as disability, long-term care, or liability.

· Build Emergency Funds: Having an emergency fund can help you navigate unexpected financial setbacks and provide a safety net during challenging times.

· Regularly Monitor Progress: Review and assess your financial plan regularly to track progress and make adjustments as needed. Life circumstances and goals may change, requiring updates to your plan.

· Seek Emotional Support: Special financial challenges can be emotionally taxing. Lean on family, friends, or professional counselors for emotional support during difficult times.

· Stay Informed: Stay updated on changes in tax laws, financial regulations, and investment options that may impact your financial situation.

· Remain Patient and Persistent: Overcoming financial challenges may take time and persistence. Stay focused on your goals and remains patient as you work towards solutions.

In Conclusion

While conquering unique financial challenges may initially appear formidable, the synergy of expert planning and a well-defined strategy can metamorphose challenges into stepping stones toward financial triumph. You need not undertake this journey alone. Seek the guidance of professionals who grasp the intricacies of your circumstances and can shepherd you toward a brighter financial horizon. Embrace the prowess of meticulous planning, and witness your navigation through complexity transform into a journey characterized by confidence and assurance.

Remember that addressing special financial challenges may require time and effort, but with proper planning and support, you can navigate through them and achieve financial stability and success.

STORY ABOUT SPECIAL FINANCIAL ISSUES AND HOW TO OVERCOME IT

Himanshu Singh, who had big dreams and aspirations. He wanted to pursue higher education, start his own business, and secure a comfortable retirement. However, he faced several special financial challenges that seemed like formidable hurdles in his path.

First, Himanshu came from a modest background, and his family could not afford the high costs of higher education. He knew that without a good education, achieving his dreams would be difficult. But Himanshu was determined to overcome this challenge. He researched scholarships and grants and worked tirelessly to excel in his studies. His hard work paid off, and he secured a scholarship to a reputable university.

While pursuing his education, Himanshu faced another financial hurdle. He had a great business idea, but he lacked the capital to bring it to life. He approached banks for loans, but they were hesitant to lend to a young entrepreneur without collateral. Undeterred, Himanshu explored alternative funding options, including crowd funding and angel investors. With persistence and a convincing business plan, he managed to secure the funds needed to start his business.

As Himanshu’s business grew, he faced yet another challenge – managing his personal finances while handling the financial responsibilities of his business. The lines between personal and business finances blurred, and he found himself struggling to stay on top of both. To address this issue, he sought the help of a financial advisor who guided him in separating his personal and business finances and implementing a budgeting strategy to maintain financial stability.

Just when things were looking up, Himanshu faced an unexpected medical emergency that resulted in significant medical bills. He had never considered the importance of health insurance, and this incident served as a wake-up call. He immediately purchased health insurance to protect himself from future financial burdens.

As years passed, Himanshu’s business prospered, and he accumulated substantial wealth. However, he knew he needed to plan for the future. Retirement seemed distant, but he did not want to wait until it was too late. He consulted with a retirement planner who helped him develop a comprehensive retirement plan that considered inflation, investment diversification, and potential healthcare costs.

With careful financial planning, Himanshu achieved his dreams one by one. He successfully expanded his business, secured his future with a well-funded retirement account, and even managed to contribute to causes he cared deeply about through philanthropic endeavors.

Himanshu’s journey taught him the importance of addressing special financial challenges with determination, patience, and seeking expert guidance when needed. He realized that financial planning is not just about making money but also about managing it wisely to create a secure and fulfilling future.

As Himanshu looked back on his journey, he was grateful for the obstacles he had overcome. Those challenges had shaped him into a financially responsible and resilient individual. He knew that no matter what the future held, he was well-prepared to face it with confidence and optimism.